Zeroing in on Zero Emissions ‒ A Sharp Bend Ahead

Reducing or eliminating emissions from passenger cars is an essential element of Europe’s climate strategy, which aims to achieve net zero emissions by 2050. It will require reducing carbon emissions from traditional cars with combustion engines, exploring alternative fuel options, and ensuring the mass adoption of electric vehicles. Over the past couple of years, the European Court of Auditors has published a number of related reports. These have shown that the first task has not yet been accomplished, the second seems unviable on a large scale (as illustrated by biofuels), and the third runs the risk of being costly for both the EU industry and consumers.

The EU has made progress in reducing greenhouse gas (GHG) emissions. However, this has not been the case in the transport sector, which accounts for about a quarter of all of Europe’s GHG emissions ‒ half of which come from passenger cars alone. Although testing standards have been tightened since the 2010s, our auditors found that real-world emissions from conventional cars – which still account for nearly three quarters of new vehicle registrations – have not decreased materially in 12 years. Even though engines have become more efficient, cars have become around 10 % heavier on average and engines must be around 25 % more powerful to haul that weight. In addition, auditors found that plug-in hybrid cars, once thought to offer a gentle transition from traditional vehicles to electric ones, are still classified as “low-emission”, despite the gap between laboratory and real-world emissions being 250 % on average.

Alternative fuels, such as biofuels, e-fuels or hydrogen, are often mentioned as a potential replacement for petrol and diesel. However, our auditors’ report on biofuels highlighted the lack of a clear and stable roadmap addressing the sector’s long-term problems: the quantity of fuel available, the costs, and the sustainability of biofuels. First, the EU does not produce enough biomass for biofuels to be a serious alternative to traditional fossil fuels.

Furthermore, importing biomass from third countries defeats the goal of strategic autonomy in the field of energy. Second, partly due to the issues regarding demand, auditors concluded that biofuels are not yet economically competitive. Last but not least, auditors found that the sustainability of biofuels has been overestimated. Raw materials for biofuels can harm ecosystems and be detrimental to biodiversity, soil and water, raising ethical questions about the relative priorities of fuel and food.

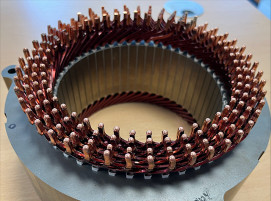

Since CO2 emissions from combustion engines have not been or cannot be reduced, battery electric vehicles look like the only viable alternative. However, auditors found that Europe’s battery industry lags behind its global competitors, potentially short-circuiting Europe’s domestic capacity before it is fully charged. Less than 10 % of global battery manufacturing is based in Europe, and this share is mostly carried out by non-European companies. Worldwide, China accounts for 76 %. One particular speed bump for the EU’s battery industry is an overwhelming reliance on raw material imports from third countries with which it does not have appropriate trade agreements. This poses risks to Europe’s strategic autonomy. And this is before even considering the social and environmental conditions under which these raw materials are mined.

The ECA auditors also highlighted that, despite significant public support, the cost of batteries made in the EU remains much higher than expected. This inevitably affects their competitiveness relative to other global players and may also mean that a large segment of the population is not able to afford European electric vehicles. New e-car sales appear to have increased substantially in Europe since the report was published (1.5 million registrations last year, or one in seven new registrations). However, recent studies have shown that these sales were publicly subsidised and were mostly in the > € 30 000 bracket. The price is mainly due to the batteries, which can cost € 15 000 on average in Europe. In short, if EU capacity and competitiveness do not increase significantly, the risk is that the “e-car revolution” in Europe will rely on imports and ultimately be detrimental to the European car industry and its more than 3 million manufacturing jobs.

Electro-mobility also requires sufficient charging infrastructure. However, in a 2021 report on charging infrastructure in the EU, our auditors found that, despite successes such as the promotion of a common EU plug standard for charging electric vehicles, there are still many obstacles to travelling across the EU in an electric vehicle. First, the number of charging points across Europe is not enough, falling significantly short – at the time of the audit – of the target of 1 million by 2025. Second, the availability of public charging stations varies considerably between countries. Finally, auditors highlighted that, in the absence of real-time information and a harmonised payment system, travelling across Europe in an electric car is still far from straightforward.

(Source: European Court of Auditors Press Release)

Schlagworte

Climate TransitionE-MobilityElectric Vehicles

![SCHWEISSEN & SCHNEIDEN 2025 [EN]](/images/frontend/journals/dvs-sus_sm.png)