European Plastics Industry PIE Market Survey

Plastics Information Europe conducted its 11th market survey, in which over 330 respondents from across Europe took part. The goal is to find out if the plastics industry can get back to normal after being hit hard by the world events of recent years.

Business performance is down

Performance generally trended lower in H2 2023 – more than half the respondents admitted the results of their commercial activity were worse in H2 2023 compared to H1; an almost equal number found it either better or unchanged. The regional split shows that business was down in Benelux particularly, where 100 per cent of the respondents said their business had deteriorated. The situation seems also grim in Central, Eastern, Southeastern, and German-speaking Europe, Italy, and the UK and Ireland. Among the industry sectors, business was particularly challenging for plastics recyclers and only slightly better for the responding companies engaged in polymer and chemical production.

European plastics at a crossroads

Over a third of the respondents believe H1 2024 will bring their business much-anticipated improvements, which would be tangibly higher than in H2 2023. Only 16.7 per cent of those surveyed expect new lows. On the domestic market, upturn is a likely scenario for 30.4 per cent of those surveyed. When it comes to exports to other European countries, this figure is slightly lower, at 29.2 per cent. Only 26.5 per cent of companies believe in the positive dynamics of their exports to non-European countries. Optimism persists in German-speaking Europe and Italy, where half of the respondents look forward to positive developments in Q1 of the new year.

Promising investment plans focused on cost-cutting

A shift in investment activities could bode well for the European plastics industry. The share of companies willing to invest is assertive, reaching almost a third, against only 19.7 per cent in H2 2023. This appetite for spending is the strongest since H1 2021. The dynamics are also significant on the other end, with only 23.9 per cent of companies admitting plans to downsize investment programmes. While lower than in H2 2023, this is a far cry from the dismal 8 per cent in H1 2021. The share of companies willing to spend more money in H1 2024 is the highest in Spain and Portugal, the UK and Ireland, and Central and Eastern Europe. Considering the soaring costs along the value chain, it is not surprising that most respondents said their investment plans are primarily focused on cost-cutting solutions, as reported by almost 57 per cent of the participants. Slightly over a quarter of those surveyed expressed readiness to jump into capacity expansion projects – a good result, given that business performance in the past couple of years left a lot to be desired.

Layoffs continue, hiring stagnant

The prevalent hiring trend continues – more companies are still letting go of employees than hiring. Nearly 30.3 per cent of the respondents admitted to layoffs in H2 2023, against 26.2 per cent in H1 2023. Only 18.2 per cent reported staff growth, compared with 19.3 per cent in H1 2023. Slightly more than half of the respondents reported no change in staff size. There seems to be light at the end of the tunnel: More companies along the plastics value chain plan hiring than the ones considering layoffs in H1 2024. Employee retention remains the preferred trend, with 65.6 per cent of the respondents expecting no major changes in workforce. Only 21.3 per cent plan to increase hiring and 13.1 per cent are looking to downsize.

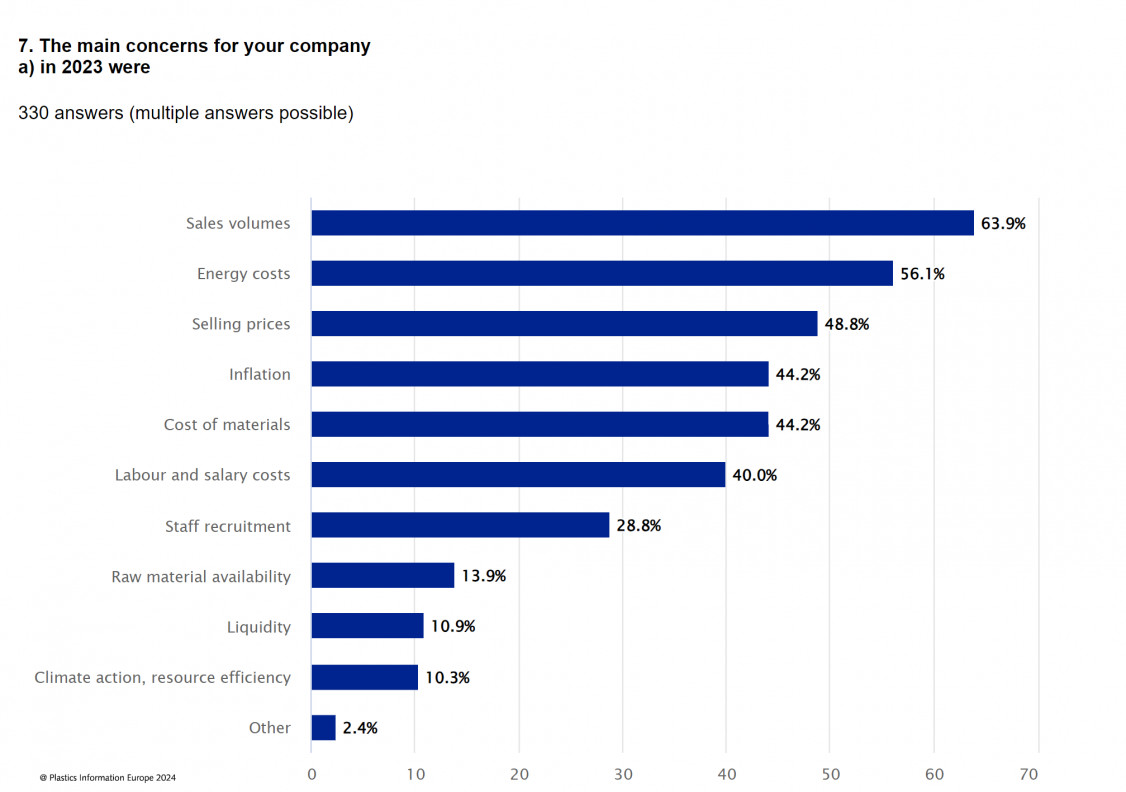

Special concerns

Sales volumes were chosen as the key concern by 63.9 per cent of the respondents, reflecting fears that with not enough demand, businesses might be forced to downsize operations. Sales prices – a factor tightly linked to the general market health – were a concern for 48.8 per cent of the surveyed companies. Energy costs continue to worry at least 56.1 per cent of the market players, while the cost of materials worries 44.2 per cent; at least 40 per cent of the companies are still marred by labour and salary costs. Though not as high as at the beginning of 2023, inflation is still cause for concern for 44.2 per cent of the respondents. Overall, businesses managed to make ends meet, as the state of liquidity concerns only 10.9 per cent of the surveyed companies.

AI not (yet) a big threat

Artificial intelligence has been around for a while, but it was in 2023 that it went mainstream and started causing chaos on the markets due to the fear of job losses. Apps like ChatGPT sparked discussions about the tectonic shifts such technologies could cause in virtually all segments. But the European plastics industry has yet to feel the impact of AI and automation. Only 9.8 per cent of the respondents believe their operations are already affected. A slight impact is recognised by 20.2 per cent, while almost half asserted that AI is yet to unravel its potential. Among the areas where managers expect the most help from digital assistants are cost reduction, increased production efficiency, and better management performance.

(Source: Plastics Information Europe Press Release)